Macroeconomic Trends Influencing Laptop Purchase Decisions in 2025

Enterprise IT teams are navigating a convergence of macroeconomic, technical, and geopolitical shifts that are reshaping how they plan for PC and laptop investments in 2025. From the end of free Windows 10 support to AI adoption and ongoing supply chain risks, organizations are facing critical decisions that will shape their technology ecosystems for years to come. These factors influence both new laptop purchases and strategies for managing used equipment through resale and recycling.

Windows Lifecycle and Compatibility Constraints

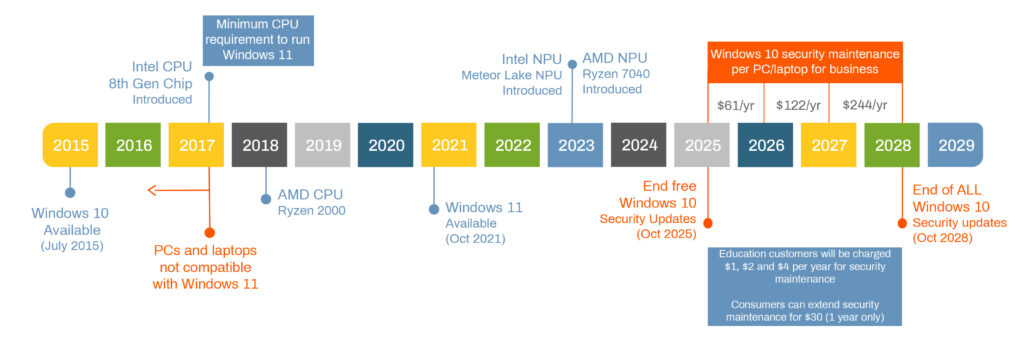

Windows 10, introduced in 2015, will reach a critical milestone in October 2025 when Microsoft ends free security updates. Organizations will then face a choice: pay escalating Extended Security Update (ESU) fees – starting at $61 per device per year and climbing to $244 annually by year three – or replace non-compliant systems outright.

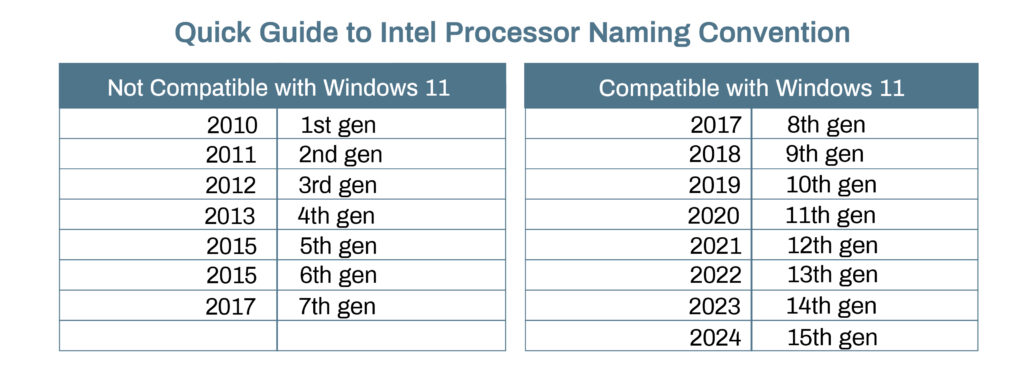

Microsoft plans to end all Windows 10 security updates by October 2028, creating a clear timeline for hardware decisions. Devices with compatible hardware can be upgraded to Windows 11 at no charge; however, PCs manufactured prior to 2017 do not meet Windows 11’s minimum requirements (an Intel 8th-generation or AMD Ryzen 2000 processor or newer).

The reality: many older systems are headed for obsolescence.

AI-Capable Laptops Offer Promise – at a Premium

A new class of AI-capable laptops is emerging, powered by processors like Intel’s Meteor Lake and AMD’s Ryzen 7040 series, both introduced in 2023. These systems integrate neural processing units (NPUs) that enable local execution of AI workloads such as real-time transcription, on-device assistants, and intelligent resource management.

While promising, AI laptops currently carry a 10–15% price premium compared to traditional CPU-powered devices. For many organizations, widespread deployment remains a tough sell unless clear productivity or privacy benefits can be demonstrated.

However, as enterprise software evolves to leverage local AI capabilities—and privacy concerns around cloud-based AI models grow—the case for AI PCs may strengthen, making today’s premiums easier to justify over time.

Geopolitical Factors in U.S. Introduce Price Volatility

Approximately 90% of laptops sold in the U.S. are manufactured in China. Ongoing geopolitical tensions and tariff uncertainties have injected volatility into procurement planning, making total cost forecasting more challenging.

The potential for sudden price increases or supply chain disruptions remains a persistent risk factor. In response, some organizations are accelerating purchases to lock in pricing and availability, using forward-buying as a risk mitigation strategy.

What Happens to Legacy Equipment? Secondary Market Outlook

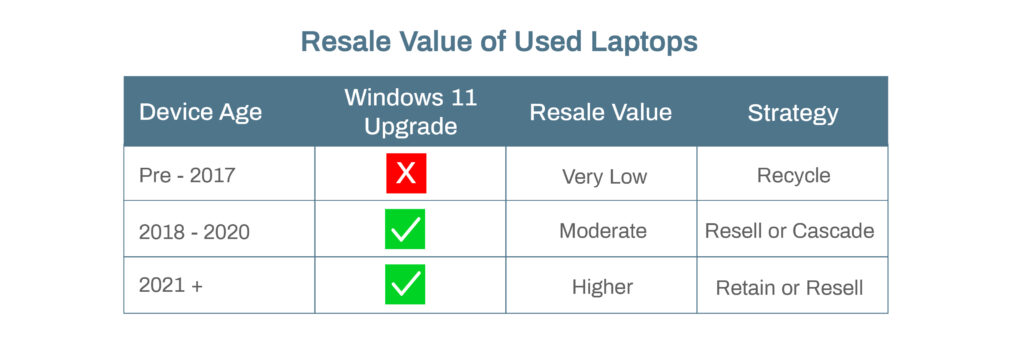

The downstream impacts of Windows 11 compatibility requirements and AI adoption are reshaping the secondary market for used laptops.

Pre-2017 devices: Systems with processors earlier than Intel’s 8th generation (late 2017) are nine or more years old, falling well outside enterprise-grade resale value. Current estimates show 7th-generation laptops (early 2017) are destined for parts harvesting or recycling.

Key takeaway: Devices manufactured before 2017 cannot support Windows 11 and face rapidly declining resale value.

2018–2020 devices: Laptops featuring 8th–10th generation Intel CPU processors retain some commercial viability. These units can either be upgraded to Windows 11 or repurposed into Linux systems. Depending on configuration and condition, 8th-generation devices (late 2017) are holding their value better than 7th generation, as of the spring of 2025.

Organizations commonly balance refresh cycles with strategies like internal cascading -reassigning newer machines to high-demand users (executives, engineers, designers) while shifting older, still-capable systems to employees with lighter workloads (such as data entry or production floor users). This approach extends device life while optimizing help desk and IT support resources.

Looking Ahead: Timing, Budgets, and Strategic Readiness

The convergence of software requirements, AI innovation, and macroeconomic risk is forcing IT and procurement leaders to rethink traditional refresh cycles. Timing is critical: buying too early risks locking in today’s premiums, while delaying upgrades risks operational disruption, higher help desk loads, and lost employee productivity.

In 2025, the laptop procurement equation is no longer just about price per unit. It’s about ensuring compatibility, compliance, and strategic readiness for a rapidly evolving technology environment. Whether through full fleet upgrades, targeted AI PC deployments, or hybrid strategies, the decisions made this year will shape budgets, sustainability initiatives, and security postures for years to come.

Is your IT strategy ready for what's next?

Discover how a proactive approach to laptop refresh cycles—and responsible resale and recycling—can give your organization an edge.